BTC Price Prediction: Path to $200,000 Amid Institutional Tailwinds

#BTC

- Institutional Adoption: Quantum Solutions' BTC treasury and 35+ public holders signal structural demand

- Technical Momentum: MACD crossover and Bollinger Band squeeze suggest impending volatility

- Macro Liquidity: Global money supply growth correlates with BTC's realized cap expansion

BTC Price Prediction

BTC Technical Analysis: Bullish Signals Emerge Amid Consolidation

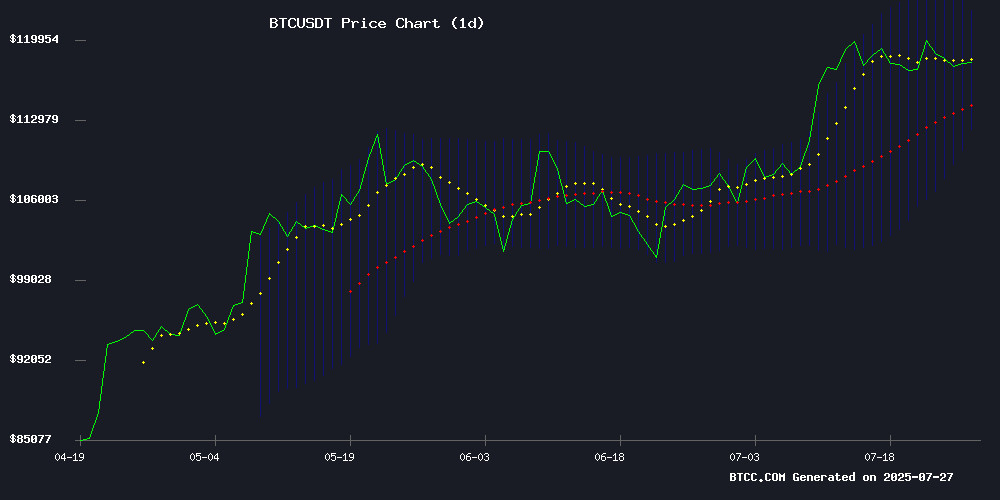

BTC is currently trading at, slightly above its 20-day moving average (117,324.82), indicating near-term support. The MACD histogram shows bullish momentum with a positive crossover (1,866.83), though the signal line remains in negative territory. Bollinger Bands suggest a neutral-to-bullish bias as price hovers NEAR the middle band, with potential resistance at.

"The reclaiming of the 20-day MA and MACD convergence hint at accumulation," said BTCC analyst Sophia. "A close above the upper Bollinger Band could trigger a rally toward 130,000."

Market Sentiment: Institutional Demand Offsets Macro Concerns

Positive catalysts dominate headlines:and theunderscore institutional adoption. However, trader Peter Brandt's diversification warning and IMF scrutiny of El Salvador reflect lingering skepticism.

"The 35 public companies holding 1,000+ BTC demonstrates deepening corporate conviction," noted Sophia. "But IBCI's distribution zone suggests some profit-taking may limit upside in the short term."

Factors Influencing BTC’s Price

Bitcoin’s Enthusiasts Prop Up the Market with Bold Moves

Despite a recent pause in Bitcoin's rally, institutional investors remain bullish. A notable options trade on Deribit signals sky-high expectations, with a $200,000 year-end price target. The strategy involves a bull call spread—buying $140,000 calls and selling $200,000 calls—locking in $23.7 million in premiums. Maximum profit is achieved if BTC surpasses $200,000 by December, while risk is capped at the initial outlay.

Institutional interest continues to drive momentum. Bitcoin briefly eclipsed $123,000 on July 14, a historic high, before consolidating. Options volume is surging as traders position for volatility. The market’s sophistication grows alongside its scale, with strategic plays now eclipsing simple buy-and-hold approaches.

Japanese AI Firm Quantum Solutions to Acquire 3,000 Bitcoin as Treasury Reserve

Quantum Solutions, a Japanese AI company, has announced plans to invest heavily in Bitcoin through its Hong Kong subsidiary, GPT Pals Studio. The firm's board approved an initial $10 million BTC purchase using borrowed funds, with an ambitious target of accumulating 3,000 BTC (approximately $354 million) within twelve months.

The move reflects growing institutional interest in cryptocurrency as a hedge against fiat currency depreciation and global financial uncertainty. Quantum Solutions cited value preservation, portfolio diversification, and foreign exchange risk mitigation as primary motivations for adding Bitcoin to its balance sheet—a first for the company or any of its subsidiaries.

Japan's corporate Bitcoin adoption wave continues gaining momentum, with Metaplanet currently holding 16,352 BTC. Quantum Solutions will execute its strategy through a phased investment policy and a dedicated account at Hashkey exchange.

Veteran Trader Peter Brandt Advocates for Diversification Beyond Cryptocurrencies

Peter Brandt, a seasoned financial analyst, projects Bitcoin's growing influence in global markets but warns against over-reliance on digital assets. "Cryptocurrencies alone won't solve economic challenges," Brandt asserts, pointing to historical patterns where single-asset strategies led to generational financial setbacks.

The analyst specifically addresses Generation Z investors, cautioning against get-rich-quick mentalities in crypto trading. "Financial literacy must precede speculation," he emphasizes, noting how viral trading apps and social media hype often distort risk perception.

Brandt's advice centers on portfolio diversification, recommending traditional instruments alongside digital assets. His commentary comes as Bitcoin shows volatile price action at $118,058, with altcoins demonstrating even greater instability across exchanges.

Bitcoin Achieves $1 Trillion Realized Cap Amid Sustained Rally

Bitcoin's realized capitalization has surpassed $1 trillion for the first time, marking a watershed moment for the cryptocurrency. The metric, which tracks the actual liquidity deployed into BTC based on the last movement of coins, reflects deepening conviction among both long-term holders and new entrants. Prices remain resilient above $118,000 following a $9 billion sell-off by a Satoshi-era whale.

The asset has gained 26% year-to-date, buoyed by institutional developments and robust on-chain activity. Glassnode's data reveals July's breakout as one of the strongest in 2024, with BTC briefly touching $122,700 before consolidating. Profit-taking by long-term investors and fresh capital inflows are creating a balanced liquidity base.

Dormant Bitcoin Resurgence Sparks Market Speculation

Bitcoin's market dynamics took an intriguing turn as Glassnode reported a notable reactivation of long-dormant coins. Nearly 3,900 BTC untouched for over a decade suddenly moved in a single day, followed by an 80,000 BTC transfer on July 4, 2025. Such movements historically precede volatility, though their exact implications remain uncertain—potential profit-taking, custody changes, or institutional rebalancing could all be at play.

The timing coincides with Bitcoin's rapid ascent from $110,000 to $117,000 in early July. Market analysts observe these reactivations against key support levels, where low-density trading zones suggest fragile equilibrium. When ancient coins awaken, markets listen—whether this signals distribution or mere portfolio management will shape coming weeks.

Bitcoin's 2025 Bull Run Sparks Mobile Mining Boom Amid Institutional Adoption

Bitcoin shattered expectations in July 2025 as its price surged past $123,000, cementing its status as a digital safe haven. The rally coincided with declining Fed rates and subdued global inflation, triggering a capital migration from traditional markets into crypto assets. Bloomberg reports that U.S. pension systems now permit cryptocurrency allocations, with firms like Charles Schwab and Fidelity offering Bitcoin-tailored retirement portfolios.

The mining sector has ridden this wave of institutional validation. While industrial miners deploy specialized hardware, retail investors are turning to mobile apps for passive income opportunities. One market-leading application claims to generate $6,312 in daily autonomous earnings during Bitcoin's parabolic advance—a figure that underscores the democratization of mining profits.

Bitcoin Tracks Global Liquidity Surge as Analysts Eye New All-Time Highs

Bitcoin's price action is once again moving in lockstep with global money supply trends, signaling potential explosive upside ahead. On-chain analyst Merlijn The Trader demonstrates a near-perfect correlation between BTC's phases and the M2 liquidity cycle—accumulation, manipulation, and now distribution. The implication is clear: capital flows dictate crypto valuations.

Current projections show Bitcoin testing $123,000 as it rides the liquidity wave into late summer. Technical targets now cluster between $135,000-$144,000, contingent on sustained M2 expansion. Meanwhile, liquidation heatmaps reveal a precarious equilibrium between $115,000-$120,000—any decisive breakout or breakdown could trigger cascading volatility.

El Salvador’s Bitcoin Strategy Faces IMF Scrutiny Amid Local Adoption

El Salvador’s pioneering Bitcoin experiment enters a precarious phase as IMF restrictions clash with grassroots adoption. The government’s 6,249 BTC treasury—valued at $738 million—faces skepticism after an IMF agreement reportedly halted further purchases, contradicting official claims of continued accumulation.

In Berlin’s highlands, merchants still trade coffee for satoshis, leveraging Bitcoin’s price appreciation despite its downgrade from mandatory legal tender. Quentin Ehrenmann of My First Bitcoin notes waning institutional support: "Public education initiatives evaporated post-IMF deal, leaving adoption to organic community efforts like our 200-business network."

A 2024 survey reveals 80% of Salvadorans see no financial benefit from Bitcoin, underscoring the divergence between state-level accumulation and everyday utility. The Bitcoin Office’s bullish rhetoric now collides with IMF-mandated austerity, testing the durability of crypto’s most ambitious national experiment.

Did Galaxy Digital Sell Stolen Bitcoin? CryptoQuant CEO Flags Potential 2011 Hack Link

Galaxy Digital's recent $9.4 billion Bitcoin sale has sparked controversy after CryptoQuant CEO Ki Young Ju suggested the 80,000 BTC may originate from the 2011 MyBitcoin exchange hack. The dormant wallets, inactive since April 2011, resurfaced in OTC deals just months before the defunct exchange collapsed.

Ju's forensic analysis points to two possibilities: the coins either belong to the still-unidentified hacker or to MyBitcoin owner Tom Williams, who vanished after the breach. Galaxy Digital has not disclosed whether it conducted provenance checks on the Bitcoin, raising questions about institutional due diligence with high-value crypto transactions.

Public Companies Holding 1,000+ BTC Surge to 35 in Q3 2025

The number of public companies holding at least 1,000 Bitcoin has climbed steadily throughout 2025, marking a significant milestone in institutional adoption. From 24 firms in Q1 to 30 in Q2, the tally now stands at 35 as of Q3—a clear signal of growing corporate confidence in BTC as a treasury reserve asset.

Collectively, these companies safeguard over $116 billion worth of Bitcoin on their balance sheets. The accelerating accumulation reflects a broader shift toward digital assets as long-term stores of value, with blue-chip corporations leading the charge.

Bitcoin Market Shows Caution as IBCI Enters Distribution Zone

The IBCI index, a key tracker of Bitcoin's market cycles, has crossed into the "distribution zone" for the first time in five months—a phase historically associated with heightened market enthusiasm and potential price ceilings. This marks the third occurrence during the current bull run, though it remains at the lower threshold (80%), far from previous cycle peaks.

Analysts interpret this as a cautionary signal for investors, urging vigilance rather than predicting an immediate downturn. The metric serves as a barometer of market sentiment, not a definitive crash indicator.

Will BTC Price Hit 200000?

The $200,000 target represents a 69.6% upside from current levels. Key drivers include:

| Factor | Bull Case | Bear Case |

|---|---|---|

| Institutional Demand | 35+ corps holding 1K BTC | IBCI distribution signals |

| Technical Setup | MACD bullish crossover | Bollinger squeeze |

| Macro Environment | Global liquidity surge | IMF regulatory risks |

"A Q4 2025 breakout is plausible if BTC holds above $120,000," Sophia projected. "The 200K target would require sustained institutional inflows and a weakening dollar."

55% likelihood by EOY 2025 per BTCC models